retroactive capital gains tax hike

Obama presidential center to break ground in Chicago amid years of pushback. A natural reaction to a looming tax hike is to sell quickly before the new law takes effect.

What Can The Wealthy Do About Biden S Proposed Tax Increases

Are retroactive tax increases constitutional or even fair.

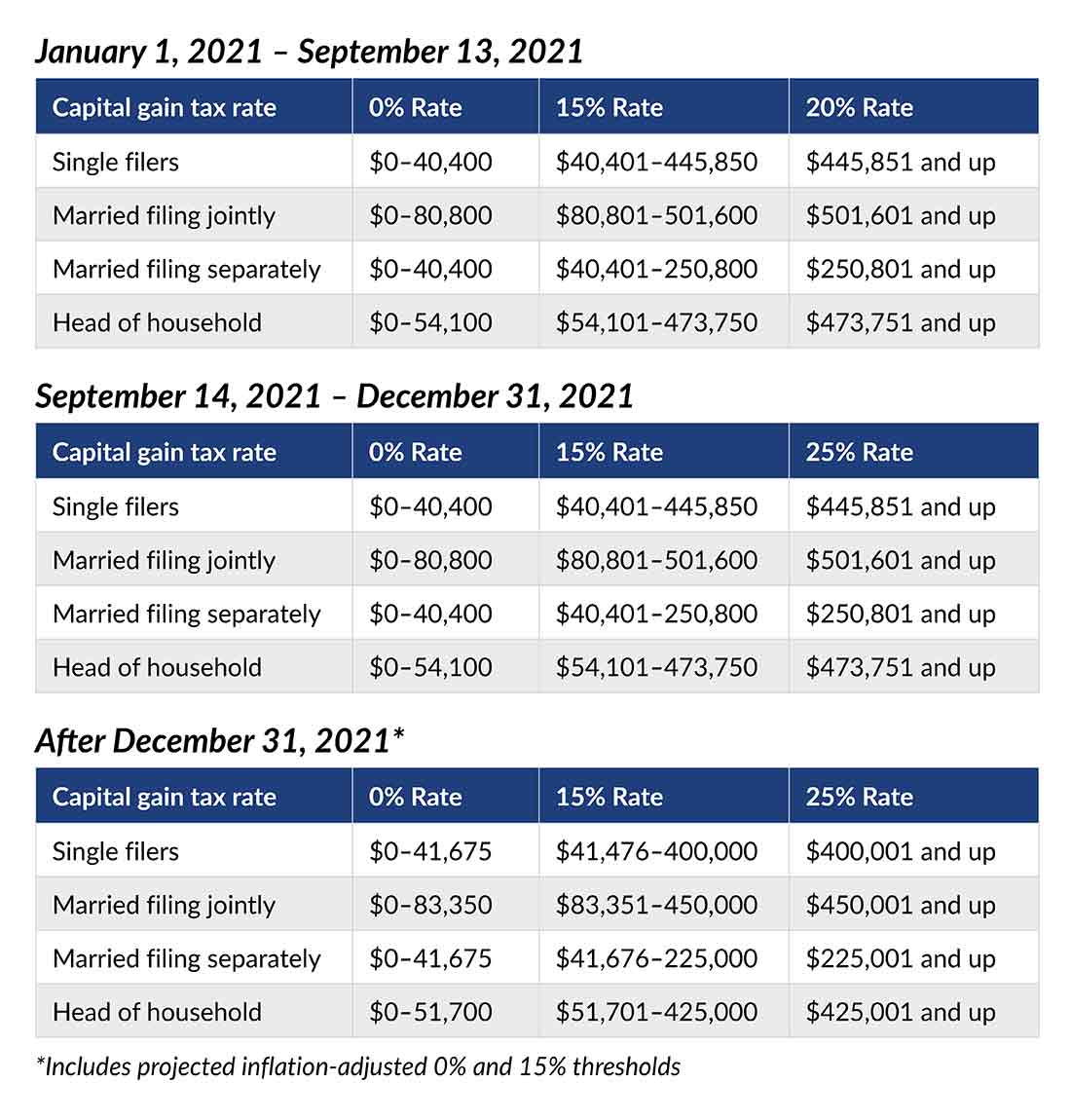

. June 16 2021 1108 AM PDT. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

May 31 2021 at 1250 pm. Report By Victor Reklaitis May 27 2021 President Joe Bidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for high-income investors to realize gains at. Otherswhich will likely not be introduced retroactively but instead for 2022 and beyond include increasing the top marginal income tax rate for high earners introducing a capital gains tax on property transferred by gift or by.

President Biden has been clear that he wants to raise taxes on capital gains for high earners. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Andrew Keshner 5312021.

In some cases you add the 38 Obamacare. Biden plans retroactive hike in capital-gains taxes so it may be already too late for investors to avoid it. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37 percent being the highest rate 408 percent including the net investment income tax.

And remember that the capital gains hike isnt the only tax increase proposed for the near future. May 28 2021 at 359 pm. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

Including raising the capital-gains tax taxes paid on the value. Are retroactive tax increases constitutional or even fair. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021. Retroactive Tax Increase. The capital gains tax hike would be retroactive to the date of announcement making it.

President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the administrations American. Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code. In the months since President Biden announced his tax reform proposal that included a tax hike on income recognized from capital gains investors have been keeping a close eye on the political climate and the likelihood that this change would be enacted.

Currently there are only 3 federal tax rates on capital gain income which are simply 0 15 or 20. Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income.

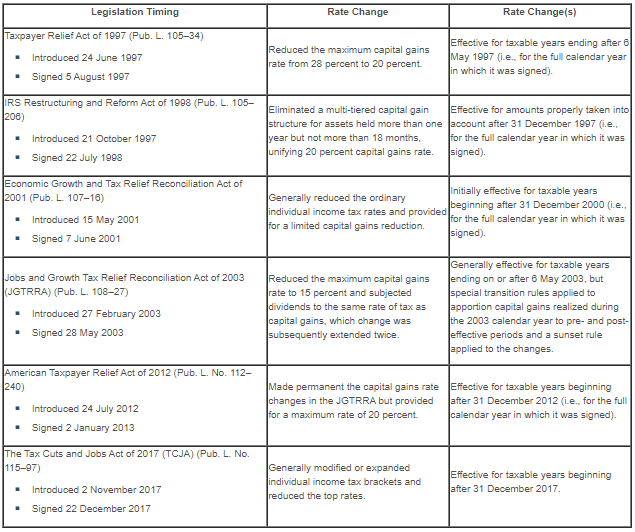

Signed 5 August 1997. Taxes on capital gains on a retroactive basis. Advisors look for ways to lessen Bidens proposed retroactive capital gains tax hike President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Reduced the maximum capital gains rate from 28 percent to 20 percent. Wall Street panicking that Bidens tax hikes will be retroactive By.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. If you add state taxes like Californias current 133 rate the government gets most of your gain. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238. 46th and current president of the United States.

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

Advisers Blast Biden S Retroactive Capital Gains Proposal

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

2021 2022 Proposed Tax Changes Wiser Wealth Management

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Biden S Proposed Retroactive Capital Gains Tax Increase

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc